Company Tax Computation Format Malaysia

Section 2 42C of The Income Tax Act 1961 recognises Slump-Sale as a transfer of an undertaking ie. Income Tax Assessment Year 2023-24.

Format Computation 1 Xlsx Computation Of Chargeable Income Tax For Ya Xxxx Husband Wife S 4 A Business Income Adjusted Income Add Balancing Course Hero

Click the preview icon to view the accounts tax return or tax computation summary in document format.

. Miguel de Serpa Soares the Under-Secretary-General and United Nations Legal Counsel. Salaries of the employees of both private and public sector organizations are composed of a number of. Read More View More.

The selling price of a product charged by the parent company to the subsidiary company may differ from the selling price with an independent third party. Limiting the scope of the rule to covered payments between connected persons is in line with the policy and purpose of the STTR as articulated in section 91 above. The different Sections of the Income Tax Act help the salaried individuals and the self-employed people and professionals to make their rent expenditures cheaper and more desirable.

The proforma can also be downloaded in Excel formatThe Checklist preparation of the corporation tax computation sets out a list of queries that may be helpful in gathering the information required to complete the computationTrading profitsThe calculation of trading profits and the adjustments that must be made for companies is dealt with in the Adjustment. Were recruiting Tax Accountants specialising in VAT. Mobile TaxComp - Allow users to compute TaxCompe-filing at anytime and anywhere.

Non issuance of receipts is a violation of the NIRC of 1997 as. Allow multiple user to access and update a clients file concurrently. Inclusive of Personal e-Filing.

Xero Tax displays the company information stored at Companies House. You can edit the format of the company name and directors names if you dont want to use the Companies House format. Check company information and statutory filing deadlines.

So if youre the super safe type of person just make sure that dividend is paid by from the company to your personal UK bank account rather than direct to your Thai bank account and dont bring those particular into Thailand for at least one year. Log Mode and Tag Mode Data Processable Through a Personal Computer. Format of delivery receipt does not bear any amount for the goodsservices delivered.

Acting on the recommendation to prevent erosion of Indias tax base the Income Tax Act 1961 was amended in April 2001 by substituting the existing section 92 and inserting sections 92A to 92F to introduce Indian transfer pricing regulations TPR in line with Article 9 of the Organization for Economic Co-operation and Development Guidelines OECD guidelines on. Rates of Depreciation as Per Income Tax Act 1961. Article contains Automatic Income Tax Calculator in Excel Format for Financial Year 2022-23 FY 22-23 ie.

Article 9 OECD Model Tax Convention On Income and On Capital - OECD defines related companies as. HRA or House Rent allowance also provides for tax exemptions. Dividends are tax free as long as the money is only brought into thailand after 1 year.

However such GST paid is also allowed as Input tax credit in same month and therefore net liability of tax will not increase. In other words slump sale means transfer of the entire business unit for a single lump sum consideration without assigning value to individual assets and. Income Tax Calculator is Useful.

Buyer must not release any payment to supplier without issuing the evidence of payment such as Sales InvoiceOfficial Receipt. Block of Assets -The expressions Assets and Blocks of Assets wef. UNLIMITED clients and users.

This service is listed under the reverse charge list therefore trader has to pay tax 18 on Rs. 1-4-1999 shall mean a group of assets. Example A trader who is registered in GST takes services of Goods Transport Agency GTA for Rs.

However if any of. A part or a unit or a division of a company which constitutes a business activity when taken as a whole. Controlled company - interpreted under Section 2 Income Tax Act 1967 ITA 1967 as a company having not more than fifty members and controlled by not more than five persons in the manner described by Section 139 ITA 1967.

Thus such document cannot be used to claim any expense as a form of tax deduction. A connected persons requirement ensures that the rule focuses on those cross-border tax planning arrangements that are designed to shift an amount from the source. Defined value DV DV value for real property means market value of the real property.

1- Experience 2 to 3 years in UAE - Junior Level 2- Assist in tax registration with the Federal Tax Authorities. This determination of the sale price may be referred to as the transfer price. We would like to show you a description here but the site wont allow us.

K E J T 0 to 5 V and 0 to 20 mA Simultaneous 4-Channel Measurement and Display HighLow Alarms for Each Channel Computation.

Malaysia Taxation Junior Diary Non Income Producing Dormant Inactive

Tax Computation Format Lessor Company Name Computation Of Chargeable Incom For Ya Xxxx Rm Leasing Business Gross Income Less Wholly Exclusively Course Hero

Tax Computation Malaysia Fill Online Printable Fillable Blank Pdffiller

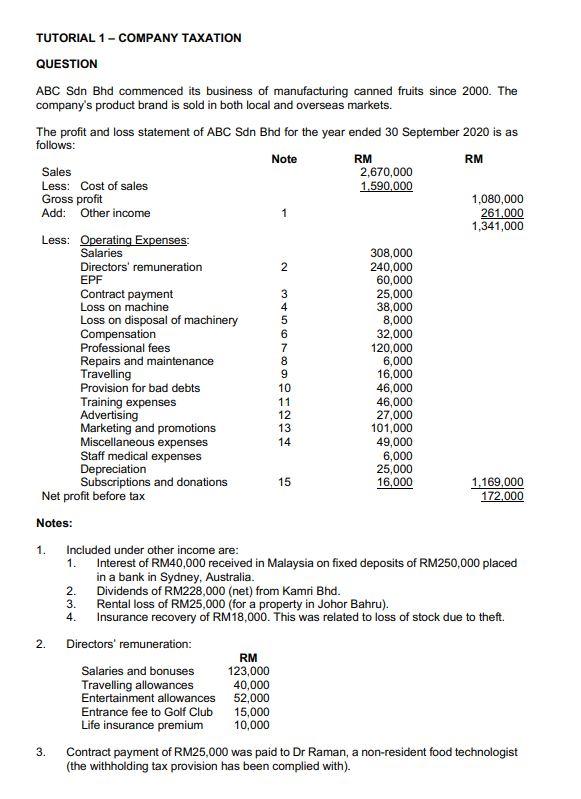

Tutorial To Malaysia Income Tax Computation Answer To Bobby Yap Youtube

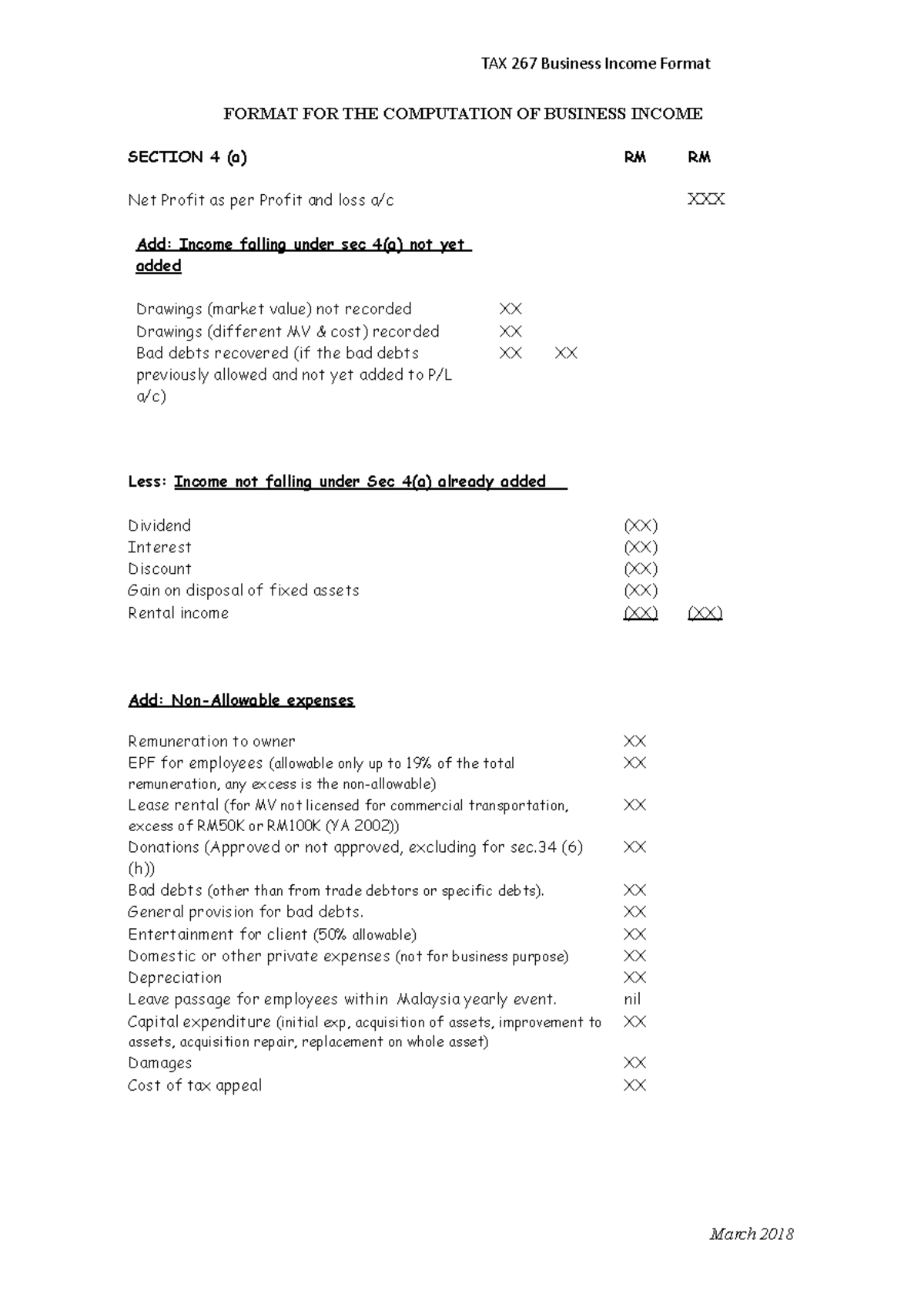

Format For The Computation Of Business Income Tax 267 Business Income Format Format For The Studocu

Comments

Post a Comment