Determine the Total Liabilities for the Period

Total assets 100000 Total liabilities 20000 Total owners equity 80000 Current assets 10000 Current liabilities 5000 The companys net working capital. Depreciation Expense250 Miscellaneous Expense 185 Totals 30490 30490 Determine the net income loss for the period.

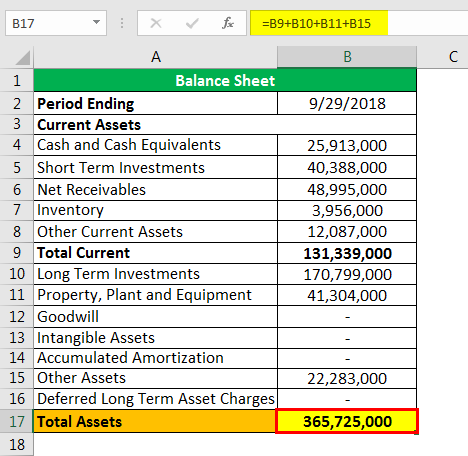

Total Assets Definition Example Applications Of Total Assets

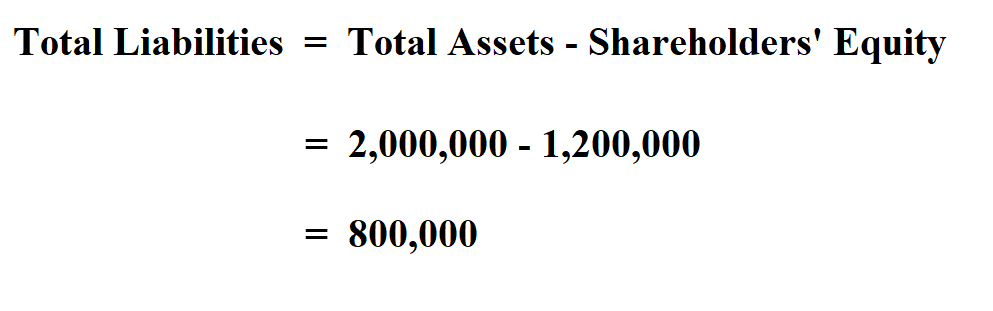

If you want to know what would happen if the company closed you need to look at the value of its assets the amount of its total current and non-current liabilities and how much.

:max_bytes(150000):strip_icc()/phpdQXsCD-204ee8d463444c6c90f775fd179810f3.png)

. Asked Feb 25 2019 in. After Net Income or Loss is entered on the end-of-period spreadsheet the debit column total must equal the credit column total for the Balance Sheet pair of columns. Once you have identified the liabilities due within one year you need to add them up to find your total current liabilities.

After the income statement and the retained earnings statement. Should end at the height of the businesss annual operating cycle. Current liabilities notes payable accounts payable short-term loans accrued expenses unearned revenue current portion of long-term debts other short-term debts.

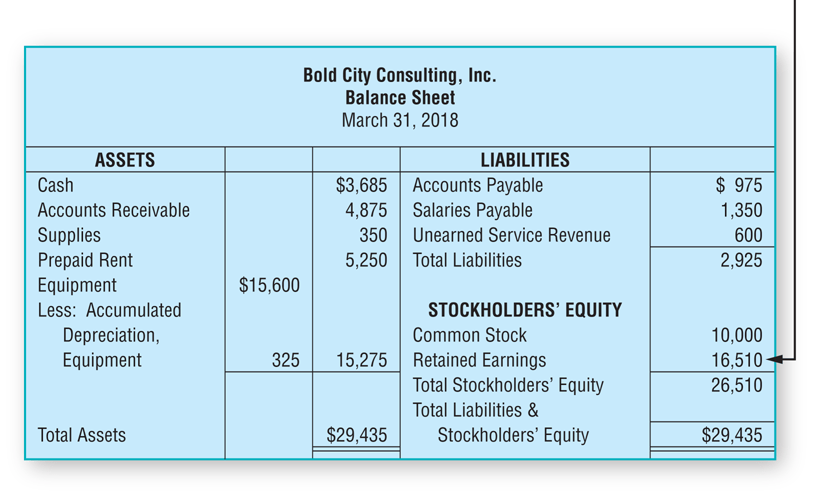

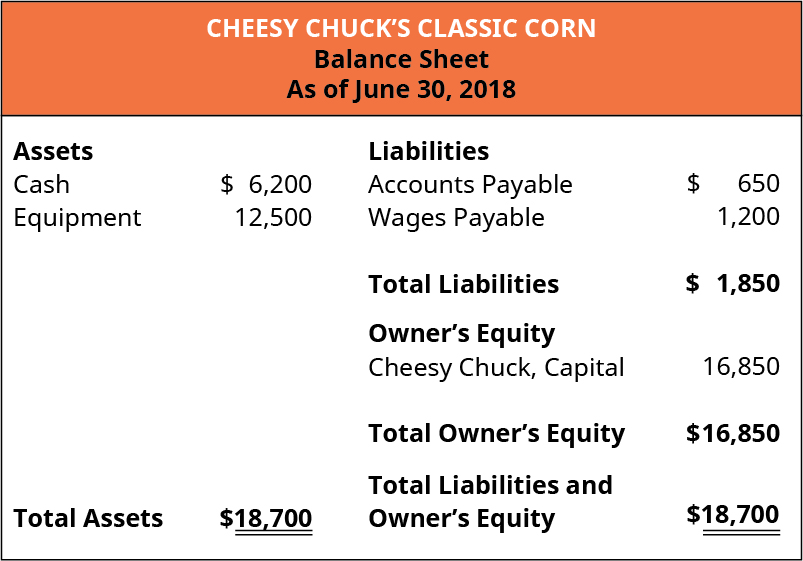

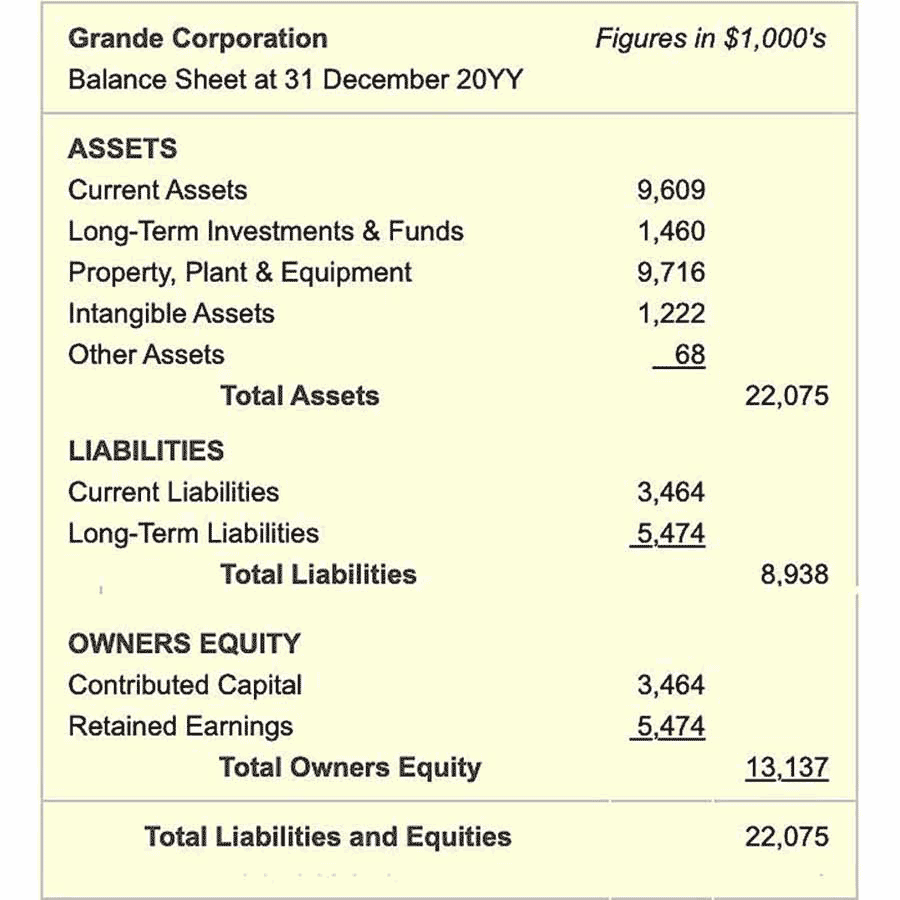

Determine the total liabilities for the period. Determine the total liabilities for the period. Determine the total assets.

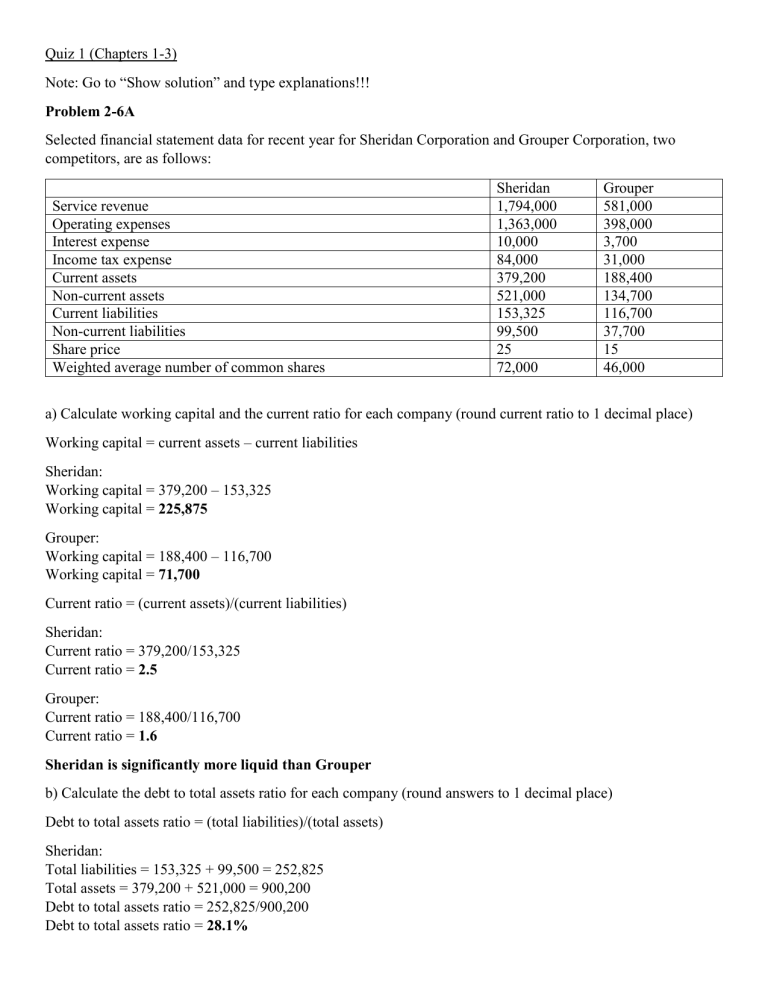

After posting the second closing entry to the income summary accounts the balance will be equal to. Calculating Corporate Liabilities. Solution for If total assets increased 20000 during a period and total liabilities increased 12000 during the same period the amount and direction.

Helping business owners for over 15 years. Companies with high proportions of debt to their shareholders equity positions are less able to weather economic downturns and remain competitive in. Current Liabilities 27907.

Start studying the chapter 4 flashcards containing study terms like 1. Current assets - cash - accounts receivable - supplies - prepaid insurance Fixed assets. The balance sheet should be prepared.

Total Liabilities Accounts Payable Notes Payable 1486 4350 5836 The accounting cycle requires three trial balances be done. The post-closing trial balance differs from the adjusted trial balance in that it doe not. Asked Feb 25 2019 in Business by Eniaya26.

Current Liabilities Borrowings Trade payables Other Financial Liabilities Other current Liabilities Provisions Current Tax Liabilities. The calculation of total liabilities and equity position of a company is important to determine its financial health. Relevance and Uses of Current Liabilities Formula.

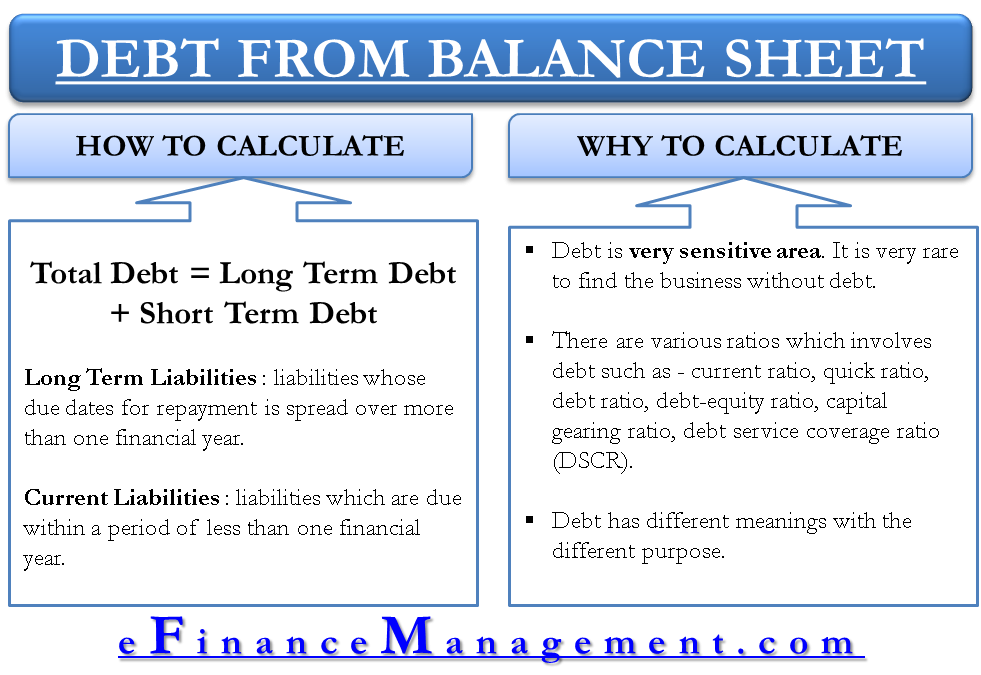

Ordinarily begins on the first day of a month and ends on the last day of the following twelfth month. You would use the following formula or some variation of it. Short-term long-term and other liabilities are generally considered to be the same.

How Do You Calculate Total Liabilities And Total Equity. If you are looking at investing in a corporate stock look at the balance sheet for assets liabilities and stockholders equity. Current Liabilities 190647.

The total current liabilities for the reliance industries for the period are Rs 190647 cr. Adding the number of equity shares to total liabilities allows you to see total shareholder equity. The net income or net loss for the period.

Stockton Company Adjusted Trial Balance For the Year ended December 31 2010 Cash 6030 Accounts Receivable 2100 Prepaid Expenses 700 Equipment 13700 Accumulated Depreciation 1100 Accounts Payable 1900 Notes Payable 4200 Bob Steely Capital 12940 Bob Steely Withdrawals 790 Fees. Add the two figures together and. Current Liabilities 13009 9921 4110 347 283 237.

Then get the total value of current liabilities from the balance sheet at the end of the period. For a business is determined by the federal government. Determine the total liabilities for the period.

Total liabilities are calculated by summing all short-term and long-term liabilities along with any off-balance sheet liabilities that corporations may incur. Determine the total liabilities for the period. It implies the company is liable for Rs 190647 cr within one year.

Determine the total liabilities for the period. Current Liabilities is calculated using the formula given below. Determine the total assets.

In the balance sheet for the period summarize the total assets of the company. Take into account closing entries. An individual or companys total liabilities refer to both its individual and corporate debts.

Get the total value of current liabilities as recorded on the balance sheet for the beginning of the period. It is the amount that is generally concerned for a particular business cycle. Memorize flashcards and build a practice test to quiz yourself before your exam.

22930 add up assets balance sheet. Revenues for the period. The net income or net loss for the period.

Always begins on January 1 and ends on December 31 of the same year. You must include total assets plus total liabilities on the balance sheet. A separate list for all liabilities should be listed in the balance sheet.

Totals 28890 28890 Determine the total liabilities for the period A 1900 B 6100 from ACC 403 at Providence College. The following amounts were taken from a companys balance sheet. Determine the total liabilities for.

How To Calculate Total Debt From Balance Sheet Efinancemanagement

Mgcr 211 Financial Accounting Quiz 1 Chapters 1 3

Understanding Net Worth Ag Decision Maker

How To Calculate Total Liabilities

/Clipboard02-5c6ecfab46e0fb0001b6815b.jpg)

Expanded Accounting Equation Definition

/dotdash_Final_Current_Liabilities_Sep_2020-01-6515e265cfd34787ae2b0a30e9f1ccc8.jpg)

Current Liabilities Definition

How To Calculate Liabilities A Step By Step Guide For Small Businesses

/Clipboard02-5c6ecfab46e0fb0001b6815b.jpg)

Expanded Accounting Equation Definition

Adjusted Trial Balance Example Format

/phpdQXsCD-204ee8d463444c6c90f775fd179810f3.png)

How Do You Calculate A Company S Equity

Balance Sheet Definition Examples Assets Liabilities Equity

Prepare An Income Statement Statement Of Owner S Equity And Balance Sheet Principles Of Accounting Volume 1 Financial Accounting

:max_bytes(150000):strip_icc()/phpdQXsCD-204ee8d463444c6c90f775fd179810f3.png)

How Do You Calculate A Company S Equity

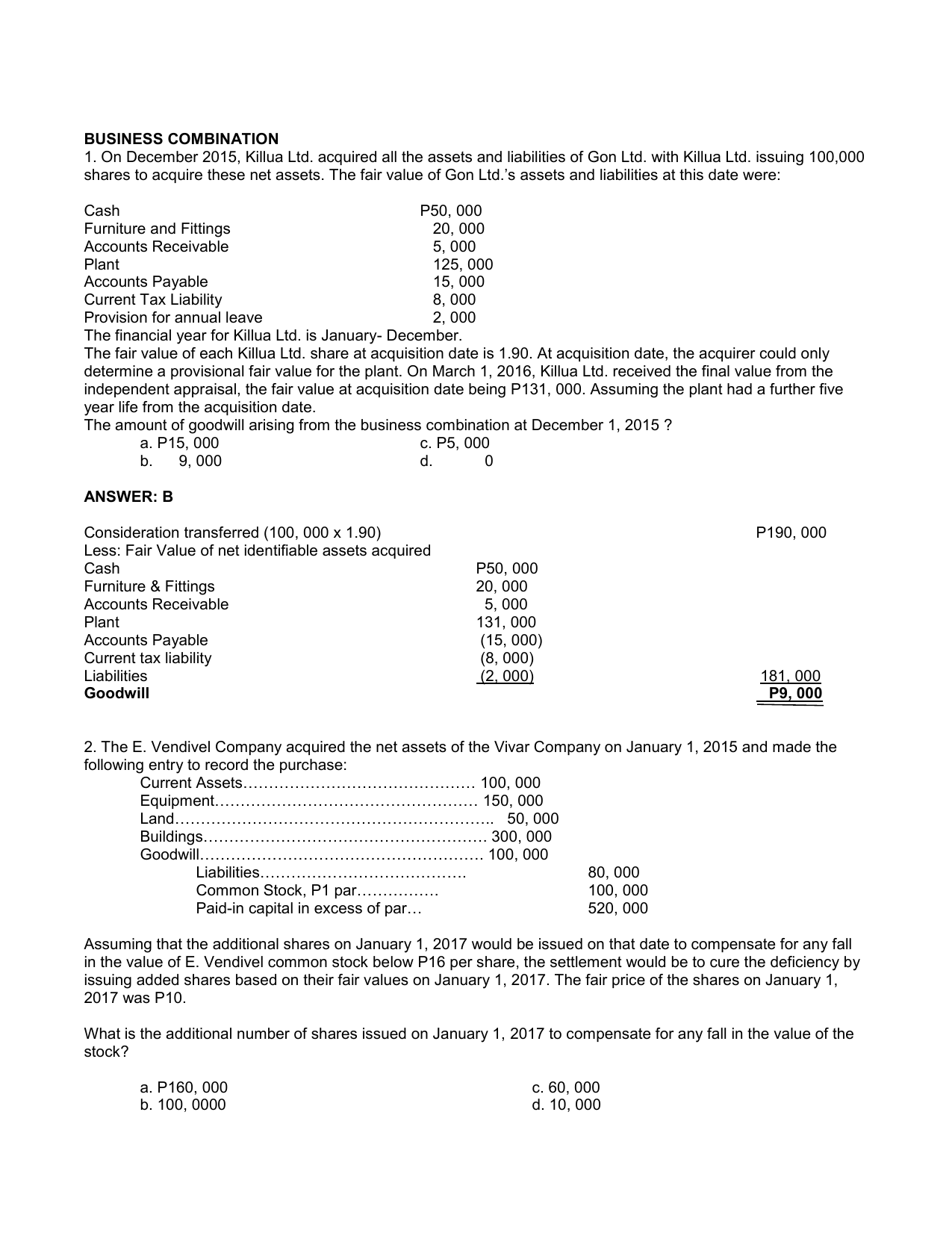

Cfas Pfa And Tfa Pdf Retained Earnings Debits And Credits

Acct 201 Midterm Flashcards Quizlet

How Balance Sheet Structure Content Reveal Financial Position Balance Sheet Financial Position Financial Statement

Owners Equity Net Worth And Balance Sheet Book Value Explained

/ScreenShot2021-08-21at5.02.29PM-f5d77e3185ff4122a026ba2a6c89c6de.png)

Comments

Post a Comment